Introduction

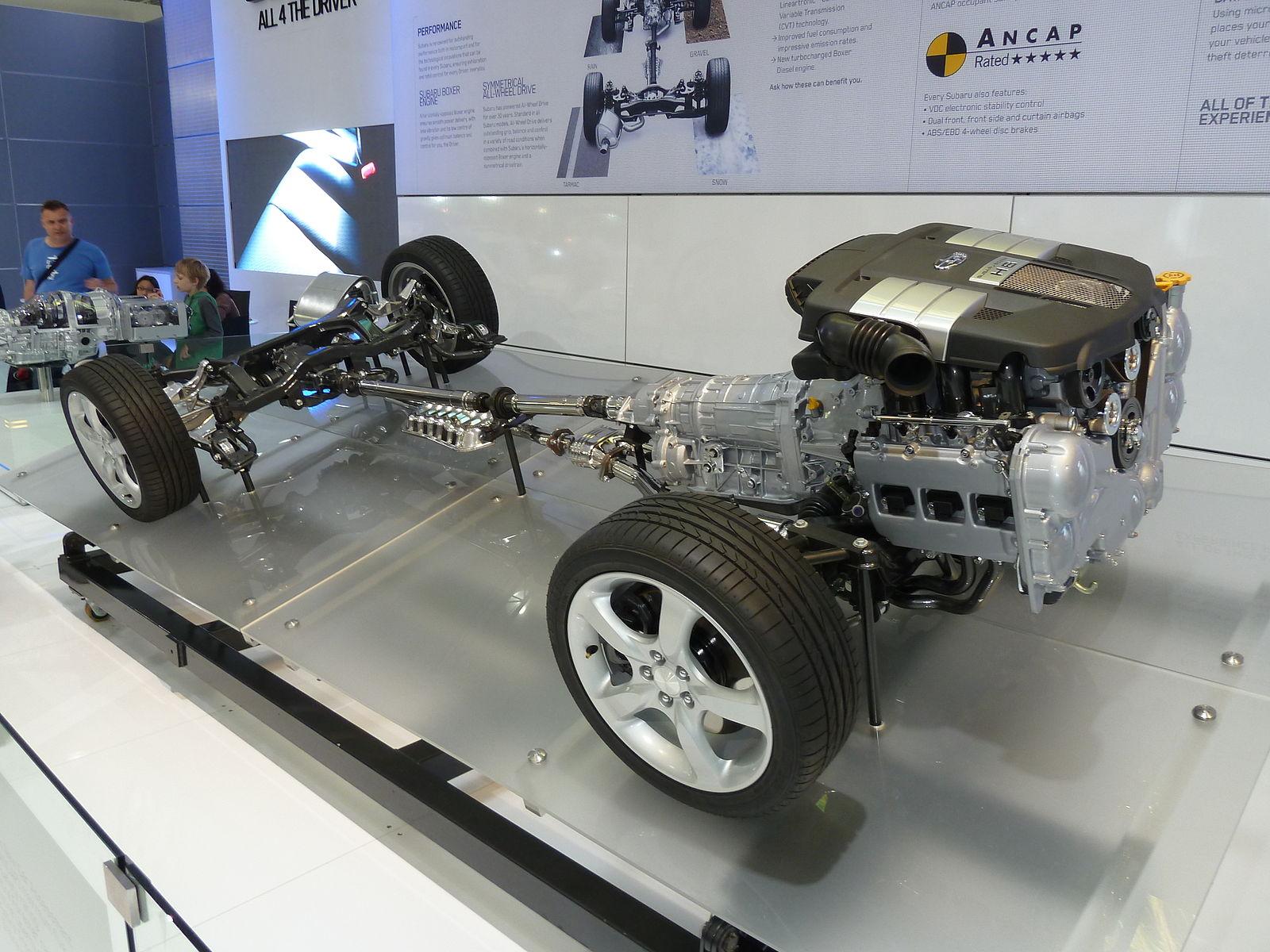

The US automotive powertrain management system market is gaining momentum as automakers shift toward more efficient, intelligent, and electrified propulsion systems. A powertrain management system (PMS) integrates control over all major powertrain components—including engines, transmissions, batteries, and electric drives—to optimize performance, fuel economy, and emissions. With the US automotive sector accelerating toward sustainability and connected mobility, these systems are becoming the backbone of next-generation vehicles. The integration of artificial intelligence (AI), advanced sensors, and cloud-based analytics has transformed traditional mechanical control systems into dynamic, software-driven architectures that respond in real time to driving conditions and driver behavior.

Market Drivers

The transition to electric and hybrid powertrains is the strongest growth driver. As OEMs redesign vehicle architectures, advanced PMS platforms help coordinate electric motor torque, regenerative braking, and battery management to maximize efficiency. Additionally, stricter fuel economy and emission norms from the Environmental Protection Agency (EPA) and California Air Resources Board (CARB) are pushing automakers to adopt smart powertrain optimization technologies. The demand for improved drivability, predictive maintenance, and adaptive driving modes is boosting investments in mechatronic systems and power electronics. The expansion of vehicle electrification across commercial fleets and passenger cars further strengthens the market outlook.

Market Challenges

Despite its potential, the PMS market faces technical and structural challenges. Integrating diverse powertrain components—particularly in hybrid vehicles—requires advanced algorithms and high-speed communication networks, raising system complexity and cost. Dependence on semiconductor chips for controllers and sensors makes the market vulnerable to supply chain disruptions. Cybersecurity risks are another concern, as modern powertrain systems connect to cloud and telematics networks. Additionally, developing standardized interfaces across multiple OEMs and component suppliers remains difficult, slowing interoperability. High R&D costs and the need for specialized testing infrastructure also limit small suppliers’ entry into the market.

Market Opportunities

Opportunities abound in AI-enabled control systems, cloud-connected diagnostics, and energy-optimized hybrid management. The integration of over-the-air (OTA) updates and real-time analytics can help automakers enhance system performance post-sale, opening new revenue streams. Startups and Tier-1 suppliers are exploring modular PMS architectures that can scale across vehicle segments—from compact EVs to heavy-duty trucks—thereby reducing development costs. Emerging technologies such as solid-state batteries, thermal energy recovery, and electric turbochargers create new avenues for system-level optimization. The rise of autonomous vehicles presents another opportunity: PMS platforms will play a critical role in managing propulsion efficiency and range in driverless cars.

Regional Insights

The United States stands at the forefront of global powertrain management innovation. Automotive hubs in Michigan and Ohio lead development in traditional ICE-based and hybrid powertrain optimization, while California dominates EV and software-defined powertrain technologies. Texas and Georgia are emerging as new manufacturing bases for EV powertrain systems due to their strategic proximity to battery and semiconductor plants. Federal and state-level incentives for electric mobility, such as tax credits and emission reduction grants, further accelerate adoption. Collaborations between US automakers and technology companies are driving breakthroughs in software integration, predictive analytics, and smart diagnostics for powertrain systems.

Future Outlook

The future of the US powertrain management system market will be characterized by deep software integration, predictive intelligence, and enhanced connectivity. Electric powertrains will increasingly depend on real-time energy optimization, battery state monitoring, and adaptive thermal management to extend range and reduce wear. As vehicle architectures move toward zonal computing, PMS platforms will evolve into centralized controllers managing propulsion, braking, and energy distribution. The shift to software-defined vehicles (SDVs) will make PMS upgrades and optimization software key differentiators for OEMs. Over the next decade, the convergence of AI, cloud analytics, and secure connectivity will define competitive advantage in this market.

Conclusion

The US automotive powertrain management system market is transforming the foundation of vehicle performance and efficiency. From traditional engines to electric drivetrains, PMS technologies ensure seamless integration and intelligent control of energy flow and mechanical output. While challenges such as system complexity, cost, and cybersecurity persist, innovation in software, semiconductors, and analytics continues to redefine industry standards. As electrification accelerates, the role of powertrain management systems will extend beyond efficiency—becoming the command center of intelligent mobility in the United States.