Introduction

The crystalline solar cell market focuses on solar photovoltaic cells made primarily from crystalline silicon, including monocrystalline and polycrystalline types. These cells are the most widely used technology in the global solar industry due to their high efficiency, long lifespan, and reliability. Crystalline solar cells convert sunlight into electricity for residential rooftops, commercial installations, utility-scale solar farms, and off-grid power systems. As renewable energy adoption accelerates worldwide, demand for crystalline solar cells continues to rise. Their proven performance, improving affordability, and compatibility with various solar applications make them a cornerstone of the solar PV market.

Market Drivers

The growth of the crystalline solar cell market is driven by increasing global demand for clean and sustainable energy. Governments across the world are promoting solar power through subsidies, tax incentives, and renewable energy policies. Crystalline silicon technology offers some of the highest efficiency levels in the industry, making it the preferred choice for rooftop and utility-scale installations. Falling manufacturing costs, driven by technological advancements and economies of scale, have made solar power more accessible. Rising electricity prices and growing awareness of carbon reduction are further encouraging residential, commercial, and industrial consumers to adopt solar energy systems.

Market Challenges

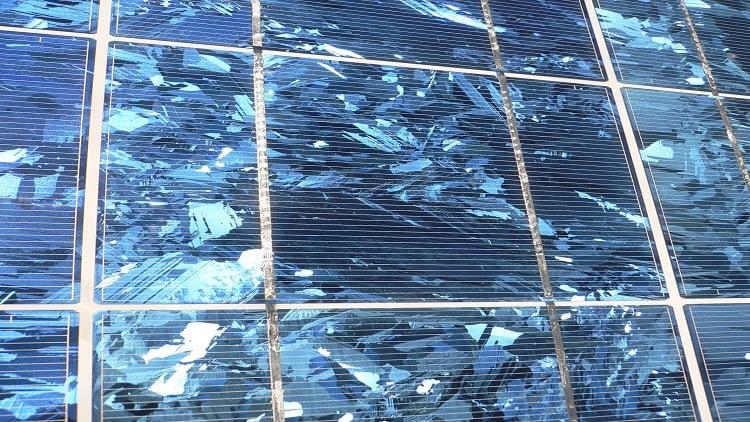

Despite its strong outlook, the market faces several challenges. Crystalline solar cells require significant energy for manufacturing, especially during silicon purification and wafer production, which increases environmental impact and initial costs. Supply chain disruptions and fluctuations in silicon material prices can affect production stability. While efficiency has improved, crystalline cells still face limitations in low-light or high-temperature environments. Competition from thin-film technologies and emerging solar innovations also creates market pressure. Installation logistics, space constraints, and the need for proper orientation can impact system performance. End-of-life recycling challenges remain an emerging concern as older solar systems begin to reach retirement age.

Market Opportunities

The crystalline solar cell market offers strong opportunities with the rising trend of smart energy systems and integrated solar technologies. Increased adoption of solar-plus-storage solutions boosts demand for efficient crystalline cells. Innovations such as bifacial modules, PERC technology, half-cut cells, and TOPCon designs are enhancing performance, opening new commercial and utility-scale opportunities. Floating solar farms, building-integrated photovoltaics (BIPV), and agrivoltaics present new application areas. Rapid electrification in emerging economies, driven by rural development and industrial growth, also expands market potential. As global interest in electric vehicles and clean energy infrastructure grows, crystalline solar cells will play an essential role in supporting the transition to renewable energy.

Regional Insights

Regional demand for crystalline solar cells varies based on solar adoption, climate, and policy frameworks. Asia-Pacific leads the market, driven by massive manufacturing capacity in China and growing installation activity in India, Japan, South Korea, and Southeast Asia. North America shows strong demand supported by federal incentives, corporate renewable commitments, and rising residential solar adoption in the United States. Europe maintains a significant share due to strict carbon reduction targets, widespread solar deployment, and advanced energy policies in Germany, Spain, Italy, and the Netherlands. The Middle East is rapidly expanding its solar infrastructure, while Latin America and Africa are emerging regions benefiting from declining solar costs and expanding electrification efforts.

Future Outlook

The future of the crystalline solar cell market appears highly promising as the world accelerates toward renewable energy adoption. Efficiency improvements will continue through technologies such as heterojunction, TOPCon, and tandem solar cells. Manufacturing processes are expected to become more energy-efficient and sustainable. Integration with smart grids, energy storage, and AI-based monitoring systems will enhance system performance and reliability. As solar becomes one of the most cost-effective energy sources globally, crystalline solar cells are expected to remain the dominant technology in both rooftop and utility-scale solar markets.

Conclusion

The crystalline solar cell market plays a foundational role in the global shift to clean and renewable energy. These cells offer high efficiency, durability, and versatility, making them suitable for a wide range of solar applications. Although challenges related to production energy use, recycling, and supply-chain fluctuations persist, ongoing innovation and expanding global solar adoption continue to drive strong market growth. As renewable energy becomes a central pillar of global power systems, crystalline solar cells will remain a vital component of future energy infrastructure.