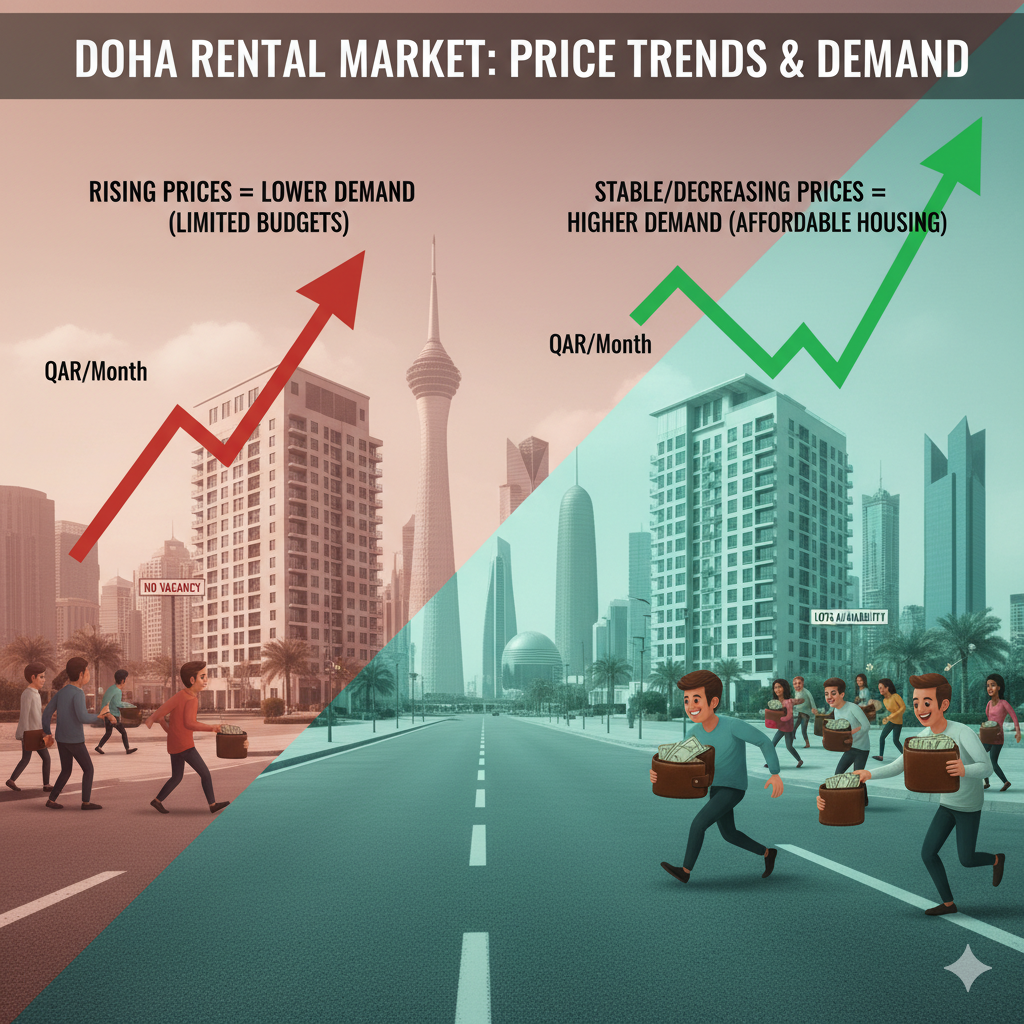

The rental market in Doha is constantly evolving, shaped by a mix of economic conditions, population growth, and property development. One of the most critical factors that influence this market is the annual price trend. Shifts in rental prices directly affect the demand for apartments for rent in Doha, as tenants, investors, and landlords adjust their decisions based on affordability, availability, and long-term expectations. Understanding this connection is vital for anyone considering renting or investing in the Qatari capital.

Price Trends as a Reflection of Economic Conditions

Annual rental price trends in Doha often mirror the overall economic situation in Qatar. When the economy grows, expatriate arrivals increase, creating greater demand for housing. This usually drives prices upward, especially in prime districts like West Bay, The Pearl, and Lusail. Conversely, during economic slowdowns, companies cut housing allowances and reduce recruitment, which lowers demand and pushes prices down. In both scenarios, rental prices act as a barometer of wider economic health and directly shape tenant choices.

Impact on Tenant Behavior

Tenants in Doha are highly responsive to changes in rental prices. When annual prices rise, many residents downsize from larger apartments to smaller units or shift from luxury areas to more affordable neighborhoods. For instance, high-income tenants may still occupy premium apartments in The Pearl, but mid-range tenants often look for more cost-effective housing in Al Sadd or Old Airport. On the other hand, when prices drop, renters see opportunities to upgrade to larger or better-located properties without significantly increasing their expenses. These behavioral shifts highlight the elasticity of demand in Doha’s rental market.

Seasonal and Annual Fluctuations

Doha’s rental market also experiences fluctuations tied to seasonal and annual cycles. The demand for apartments often rises at the start of the academic year and during major business relocations, putting upward pressure on prices. However, landlords sometimes adjust annual rates downward to maintain occupancy during quieter months. Over a longer horizon, annual trends reveal whether the market is leaning toward sustained growth or facing correction. For tenants, tracking these cycles helps in timing rental decisions to secure better deals.

Supply Growth and New Developments

The availability of new housing stock significantly influences annual price movements and, in turn, demand. Doha has seen a wave of modern apartment projects in areas like Lusail, West Bay Lagoon, and Msheireb Downtown. As more units enter the market, competition among landlords increases, often stabilizing or reducing rents. Tenants benefit from this by gaining access to more choices, better amenities, and competitive rental packages. This direct relationship between supply expansion and rental prices shifts the demand toward newly built projects that promise value for money. For instance, large-scale developments listed among the best 2025 projects to invest in Qatar demonstrate how construction booms contribute to market-wide price adjustments.

The Role of Housing Allowances

In Doha, many expatriates receive housing allowances from employers, and these allowances directly impact how price trends affect demand. When rents increase faster than allowances, tenants must compromise on property size, location, or amenities. When rents decrease or remain stable, allowances stretch further, giving tenants more flexibility to select premium apartments. This dynamic ensures that price trends have a pronounced effect on the balance between affordability and aspiration.

Rising Demand During Price Corrections

Periods of price correction, where rents drop due to oversupply or weaker economic conditions, often spark renewed demand. Tenants who were previously priced out of central locations or larger apartments seize the chance to move up the rental ladder. Families might shift from one-bedroom to two-bedroom apartments, while professionals may choose to live closer to business hubs instead of commuting from the outskirts. These shifts highlight how falling rents temporarily boost demand for higher-quality housing across Doha.

Investor Reactions to Price Trends

Landlords and investors carefully monitor annual price movements because these trends determine rental yields. Higher prices may improve short-term returns but risk reducing occupancy rates if tenants look elsewhere. Lower prices might reduce margins, but they can sustain high occupancy and ensure steady cash flow. Many investors in Qatar balance these factors by offering added amenities, flexible contracts, or value-based pricing to stay competitive. This balancing act shapes overall rental demand, as tenants are more likely to rent from landlords who adjust quickly to market realities.

Population Growth and Market Pressures

Qatar’s population growth, driven mainly by expatriate workers, is another factor that interacts with price trends. During years of rapid growth, even modest increases in rental prices do not significantly dampen demand because housing needs remain high. Conversely, when growth slows, landlords often have to adjust prices downward to attract tenants. This population-driven cycle ensures that annual price trends remain closely tied to demographic shifts.

Long-Term Tenants vs. Short-Term Residents

Annual price changes affect different groups of tenants in distinct ways. Long-term residents tend to absorb gradual price increases, often negotiating multi-year leases to secure stable rates. Short-term residents, such as consultants or contractors, are more sensitive to price fluctuations because they have limited housing budgets and prefer flexible contracts. When prices rise, short-term demand may weaken, while long-term demand remains more resilient.

Luxury vs. Affordable Apartment Segments

The impact of annual price trends also varies across market segments. Luxury apartments in areas like The Pearl or Lusail are often less sensitive to small price changes because they cater to higher-income tenants. Affordable segments, however, experience significant demand shifts even with modest annual increases. A 5% rise in rent can push many middle-income residents to relocate to secondary neighborhoods. For investors and landlords, this segmentation is critical in predicting how price trends will influence demand in different tiers of the market.

Influence of Lifestyle Expectations

Tenants in Doha increasingly seek modern amenities, security, and accessibility when choosing apartments. Even when prices rise, demand for properties with high-quality facilities remains strong, while outdated units see higher vacancy rates. Annual price trends therefore interact with lifestyle expectations, as tenants weigh whether higher costs justify the offered amenities. This trend is visible in newer developments where compound facilities, gyms, and retail options add significant value to rental decisions. Related factors that also influence demand can be observed in how compound villas with amenities stand out from regular homes, a principle that equally applies to apartments.

The Cost of Living Connection

Rental prices are one of the largest contributors to the overall cost of living in Doha. Annual price increases can strain household budgets, forcing families to cut costs in other areas or relocate to more affordable housing. Conversely, stable or declining rents ease financial pressure and can encourage expatriates to extend their stay in Qatar. This link between rental prices and cost of living makes demand highly sensitive to yearly price shifts, reinforcing the importance of tracking these changes.

Future Outlook for Apartments in Doha

Looking ahead, the demand for apartments in Doha will continue to reflect annual price trends shaped by supply expansion, economic shifts, and evolving tenant preferences. With Qatar investing in large-scale projects and modern infrastructure, the market is likely to see ongoing development and competition among landlords. Tenants will benefit from greater options, while investors will need to carefully align pricing strategies with demand patterns. For those seeking stability in an ever-changing market, monitoring annual price trends is the key to making informed decisions about apartments for rent in Doha.